Wildcat Lending is the #1 source for real estate investor financing and currently funding in multiple states. We offer purchase and refinance loans, for both seasoned and new investors, backed by competitive rates and the fastest turn times in the industry. It is our mission to ensure that our investors have the best possible lending experience from beginning to end.

This month, Caitlyn Ellison, Marketing Manager, had the privilege of meeting with one of our investors, Dana in San Antonio TX. Dana explained the ease of working with Wildcat Lending and why she chooses to use hard money.

How did you hear about Wildcat Lending?

I was blessed enough to meet wildcat through the wholesaler where I found my first house, right next door to this home.

Tell us a little bit about this property and the shape it was in when you first purchased it.

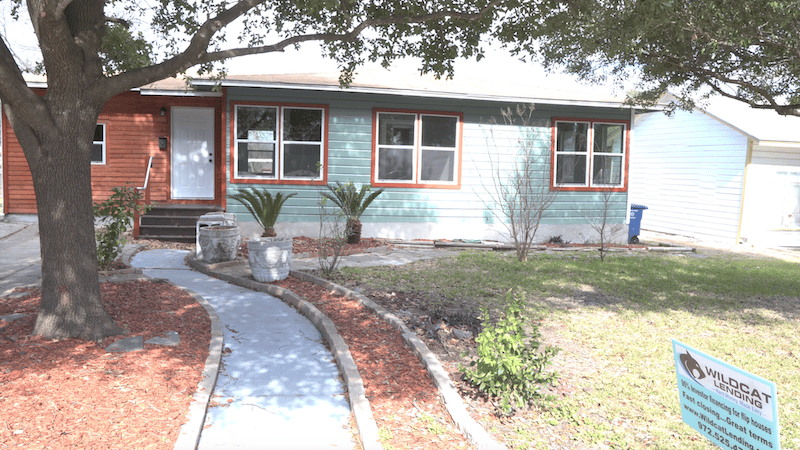

This property is a 3 bedroom, 1 bath house with a casita. In the beginning, it was worse for wear needing everything from a new roof to the foundation, just about everything you can imagine for a rehab.

Why did you choose to use hard money versus using your own capital?

I can pay cash if I want to, but being a finance person as well as a Broker, I always am very much a numbers person. I laid out the pros & cons of using hard money or paying cash for my properties. I prefer not to use cash upfront that I could use for my rehabs, or to buy another potential property that comes up.

“I could not have done or made the six figures that I did in my first month in flipping properties if it weren’t for the help of Wildcat Lending.” – Dana, Wildcat Lending Investor

What helps you choose between loan products?

Wildcat has a zero point & 16% interest loan, and they also have a product that has points upfront and a lower interest rate. I have used both products.

The way I choose my products is based on “ bottom dollar,” meaning:

- How long is it going to take me to complete the project?

- If the project takes longer to complete, it might make sense to pay the points and get the lower interest rate because you make more money in the long run.

- If you can flip the property quickly, then who cares what your interest rate is?!

- By the time your first payment comes around, it would be better for you to flip it quickly & sell it than it would be to pay the thousands of dollars in points.

Why do you choose to work with Wildcat Lending?

In simple, it is their honesty, hard work, products, and their ability to be a team partner for you through your process. They are a sounding board to help you with your decisions, get you to closing on time, and help you to make that bottom dollar that you intended on making. I could not have done or made the six figures that I did in my first month in flipping properties if it weren’t for the help of Wildcat Lending.

If you are an investor who is searching for a hard money lender that produces fast, competitive, & secure real estate loans, look no further! Give us a call to get started with Wildcat Lending today!

We close loans on time, every time!

Follow us on social media & stay up to date on the latest news!