A quality lender understands that each client is unique and that timing is everything. That is why Wildcat Lending is so successful at issuing hard money loans, bridge loans, mini-perm loans, and other private capital loans for such a wide variety of residential real estate investment properties.

Our average turn time from application to closing is less than one week but we can close in just hours if necessary!

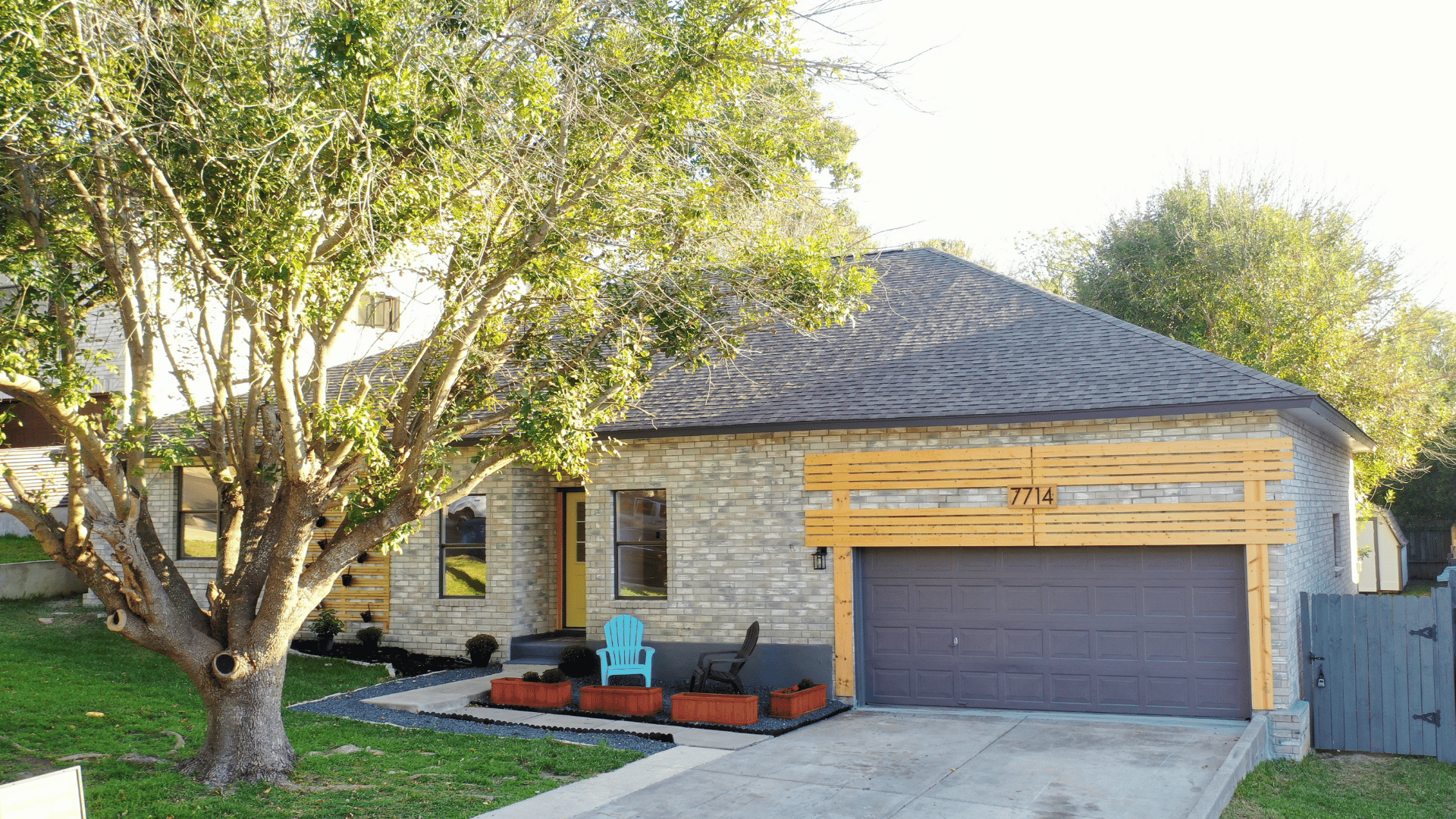

Caitlyn Ellison, Marketing Manager, recently met with one of our investors who completed a recent project using hard money in San Antonio, TX. Upon contacting Wildcat Lending, it was discovered they could get better terms with Wildcat financing than the original lender could offer them.

Keegan and James share with Caitlyn their experience with Wildcat Lending and their advice to first-time investors.

Tell us a little bit about this property, how did you find it?

I happened to be just driving by. I pulled over, did a quick search on the MLS, and found this property was back on the market. Those tend to be the properties we look for. We spoke with the Realtor who shared that the inspection had been a problem with the previous buyer. We were able to bring an inspector in to determine exactly how much the cost would be prior to purchasing. Afterward, we were able to sit down with the sellers and requested the price that we thought was fair, for them and for us.

What were your purchase price and rehab costs for this project?

We were able to purchase the home for $213,500 and we ended up spending $46,188.52 in rehab.

What were the big-ticket items?

We had the foundation inspected prior to purchasing, but we ended up finding there was a bit more work to be done on the foundation than we had originally thought.

Another big-ticket item was probably the flooring. We knew it was going to be a feature throughout the home, so we wanted to spend a little extra on that.

How did you hear about Wildcat?

I sent an SOS online saying that I needed two loans and a certain amount of cash down.

My questions for Wildcat Lending were:

- Can you get these prices?

- Can I get these houses?

- Can we do it by this time?

Wildcat Lending answered, “Absolutely, absolutely, absolutely,” following through on all their promises.

What loan program did you use?

We used Wildcat Lending’s Fix & Flip Loan:

- 12% Interest Only Payments

- 2-3 Points Origination

Do you feel that was fair market value?

The previous lender we were working with offered us 10% and 1 point, which initially we thought was fantastic, but the problem was they wanted 25% down to cover the risk. We did not have that amount of cash to put down and simply wanted to leverage our cash better.

Wildcat’s Fix & Flip loan, which offered 12% and 2 points, made more sense because we could put a lot less money down and we were able to do the project in its entirety without even requesting a draw.

Why didn’t you request a draw?

Even though Wildcat has one of the cheapest draw fees that you can get with any lender, we tried to plan our flip so we can continue through the project without having to stop and wait for the draw. For us, that is time down, and time down is money down.

What is something you can tell new investors about hard money?

Once we took the leap of faith and began this journey, we learned that hard money should actually be called, easy money! If you have the deal, the profit is there! If you have the skills, the profit is really there! So, our advice to a new investor would be, to take that leap! It was far easier than we ever thought it would be. This is actually our second time working with Wildcat. They are very supportive, very responsive, and one of my favorite things, they are your cheerleader through the process.

After completing this project within four weeks, our investors went under contract within 48 hours after listing, congratulations!

If you would like to learn more about hard money loans and how to get started on your journey to expanding your investment portfolio, contact Wildcat Lending today!

Click HERE to watch the Wildcat Walkthrough & tour our investors’ latest project!

We close on time, every time!

(972) 525-4777